GIS Enabled Property Tax Information System (GEPTIS)

Overview

GIS Enabled Property Tax Information System (GEPTIS), is BBMP’s GIS based technology platform that helps BBMP to map properties within BBMP jurisdiction. In GEPTIS, all properties have unique PIDs (Property Identifiers) along with associated property tax collection details and dues if any, etc.

GEPTIS was started with 6 Lakh PID (Property Identifiers) covering 225 sq.km and in the span of eight years GEPTIS has digitized about 20+ lakh property records covering a larger geographic area of 800 sq. kms. This is one of the largest property tax registration, digitization project undertaken by a municipal corporation in India and is a remarkable milestone for BBMP.

The revenue department in BBMP is an important contributor to corporations budgeting requirement through collection of taxes. GEPTIS helps BBMP to meet the objective of bringing transparency in tax collection data and also allows increased citizen participation thereby increasing the property tax collection amount.

BBMP’s GEPTIS platform has following major components

- GEPTIS – GIS platform and internal portal

- Online property tax system – Palike Sampanmoola – Palike 2.0– property tax portal of revenue department integrating with GEPTIS

- GEPTIS public view web portal – provides public view and feedback submission access of property tax records

- DIGI7 mobile application

- GEPTIS integration with Urban Property Owners Records UPOR and Kaveri Online

GEPTIS – GIS platform and Internal Portal

GEPTIS helps BBMP to map properties within BBMP jurisdiction on GIS map by creating a GIS enabled database of properties. GEPTIS platform also provides a set of tools to modify or add data layers to the property tax base map. For example, the property tax database within GEPTIS has unique PIDs (Property Identifiers) for each property along with the associated property tax collection details and dues if any, etc. All the 20+ lakh of digitized properties have been assigned with PID Number which is a combination of ward number – street number – plot number. Every street has been assigned with a unique street number and every property has been assigned a unique number within each street. GEPTIS also provides facility to update information relating to streets with ward and zone boundaries.

Some of the features of GEPTIS are:

- GEPTIS is a modular application that captures property tax data at granular level for properties in BBMP

- GEPTIS has property tax enrolment data for last eleven years since 2008-09

- GEPTIS provides clear demarcation of residential, commercial and other property usage

- GEPTIS helps in property assessment and tax information in a timely and accurate manner for all levels of administration. Hence, it’s a strategic tool to plan and optimize activity planning for revenue collection

- GEPTIS also provides a base for inter departmental GIS based systems

- GEPTIS provides comprehensive MIS reporting which includes

- Defaulter reports with details of zone wise ward wise defaulters and outstanding amount

- Demand collection balance (DCB) report

- Detailed collection report

- List of multi dwelling units (apartments) with property dues for current year

Online Property Tax System – Palike Sampanmoola – Palike 2.0

As per the provisions of Karnataka Municipal Corporations Act 1976, property owners in Bangalore have to pay property tax to the BBMP. The revenue department of BBMP has the responsibility to discharge the duty of property tax assessment and collection for BBMP jurisdiction area. Online property tax system also called as Palike Sampanmoola or Palike 2.0 is a property tax portal of revenue department that helps citizens to complete the self-assessment of their properties tax and also provides the option of paying the property tax either through online or through bank.

Online property tax system also provides login options to departmental users and associated banks. Departmental users get the provision of completing their work of verifying the property tax assessment. The banks use the login access to complete the remittance process done through challan mode.

The property tax database of online property tax system is linked with GEPTIS GIS platform to represent the property tax data. The BBMP IT department helps in the integration of data between the online property tax system and GEPTIS platform.

GEPTIS public view web portal

GEPTIS also exposes the GIS data layer of property tax to public at large. The access is given to registered users only. Users can complete a one-time registration process by linking their mobile number. If the registered users have used the mobile number provided as a part of their property tax records then such users are allowed to view their property tax details which also shows their property tax ownership details along with property tax dues. The users whose property records doesn’t match with the registered mobile are treated as a public viewer and get a restricted to access only the details of properties tax information and not the ownership data. There is also a restriction in terms of number of property views that can be viewed at any given point of time.

feature of GEPTIS public view web portal

Citizens are allowed to view not just their own property tax details but are also given an option to view other citizens’ properties tax details such as tax paid and dues if any. However, while viewing others’ property details, care has been taken in GEPTIS that no personal data like name of the property owner is visible to public at large. Moreover, GEPTIS allows citizens to share feedback about any discrepancies in information available such as property usage details like commercial use vs residential. This makes GEPTIS unique in identifying and updating the data through effective citizen participation.

DIGI7 mobile application

‘DiGi7’ is a digital door numbering system for the city of Bangalore. It is a 7 digit unique number identification to about 20 lakh properties within BBMP jurisdiction. DiGi7 is based on property tax payer database and property location information available in GEPTIS platform. GEPTIS platform has features of mapping tax-paying properties with unique PIDs (Property Identifiers) and associate up-to date property tax collection details as layers of information on GIS map. PIDs (Property Identifiers) defines the ward, street and house number details and follows the syntax as specified in BBMP’s 2000 manual on property tax collection. Digi7 provides multiple ways for searching property users can either enter DiGi7 id, new PID, old PID, app no or search property by location.

Unique Feature

DiGi7 mobile application integrates with GEPTIS platform to help property owners for easy identification of their property and also provides an effective way to navigate over the map in reaching out to property site location.

DiGi7 mobile application gives the option of providing feedback mechanism and empowering citizen participation in updating the data available in GEPTIS platform. The feedback feature provides an excellent way for citizens to connect with the government officials to share their requests and grievances from time to time.

Stakeholder and User Mapping

BBMP collects property tax across eight zones namely, Yelahanka, Mahadevapura Dasarahalli, Rajarajeshwari Nagar, Bommanahalli, West, South and East. Each of these zones are divided into division and sub-division, governed by Revenue Officer (RO) and Assistant Revenue Officer (ARO) respectively.

| Users | User Type | Process |

| Citizens | External |

Citizens can access the public

information on tax status of any property through GEPTIS.

Citizens log in to GEPTIS with their mobile number. If the

mobile number does not match with GEPTIS’ property owner database, then it is

treated as viewing of others property in public view. The public view gives

access only to property details such as usage, latest tax paid amount etc.

without revealing the name of owner of property.

During a single session, a public user is restricted to view certain number of properties(which is based on the limit set by BBMP) only |

| Commissioner | Internal | Internal users admin accesses to GEPTIS platform |

| Special / Additional Commissioner | Internal | Internal users admin accesses to GEPTIS platform at zonal level |

| Addn./ Joint Commissioner (Revenue) | Internal | Internal users admin accesses to GEPTIS platform at zonal level |

| Deputy Commissioner (Revenue) | Internal | Internal users admin accesses to GEPTIS platform for defined zonal level |

| Joint Commissioner (Revenue) | Internal | Internal users admin accesses to GEPTIS platform for defined zonal level |

| Revenue Officer (RO) | Internal | Supervision over assistant revenue officer and revenue staff and has access to details at division level |

| Assistant Revenue Officer (ARO) | Internal | ARO is in charge of three or four wards and heads the revenue sub-division ARO works under direct supervision and control of zonal joint commissioner/deputy commissioner ARO has access to respective sub-division level data |

| Revenue Inspector (RI) | Internal Revenue Department User | Responsible for ward level tax collectionSupervises work of tax inspectors/bill collectorsVerification of hand book, khirdi register, receipt book and remittance challan maintained by tax inspectors Monitoring issue or intimation notices, preparation of defaulter’s lists, issue of show cause notices, execution of warrants and collection property taxIdentification of new constructions, alterations and additions to existing structures changes in usage status, files tax revision proposalsProcessing applications for khatha transfer, khatha bifurcation and amalgamationListing all BBMP properties, maintaining leased properties details and collection of lease amountsRemittance of lease amount / sale amount / improvement charges to band under respective head of account and give information for computerization of the collection details |

| Tax Inspector (TI) | Internal | Listing all properties street wise, ward wise in assigned area and maintaining of hand book every yearIssue of intimation (notices) to tax payersPreparation of defaulters list, issue of show cause notices and notice to defaultersCollection of property tax by visiting house-to-house and updating collection details in system.Preparation of khirdhi book, challan and update in systemVerification of khirdhi book and remittance of challan to bankMaintaining list of activated and deactivated PID’sIssuance of tax receipt through system |

| Assessor | Internal Revenue Department User | Assist ARO in identification of under assessment and un assessed properties and files proposals for fixation and revision of tax assessments |

| Manager | Internal Revenue Department User | Works under ARO, assists in maintenance of files (demand collection and balance- DCB) and mutation registers, collection and maintains of property tax data from revenue inspectors (RI) and tax inspectors (TI). Manager attends audit observations, verifies daily collection registers and attendance registers Supervise the disposal of petitions and applications received from public and disposal of court cases |

| IT Department | Internal User | Enables revenue department officials in updating property tax records to GEPTIS Allows effective system implementation, user training, and acting on citizen feedback related to property tax records. Helps in trouble shooting of any system level access issues for both internal and external users |

Application Workflow

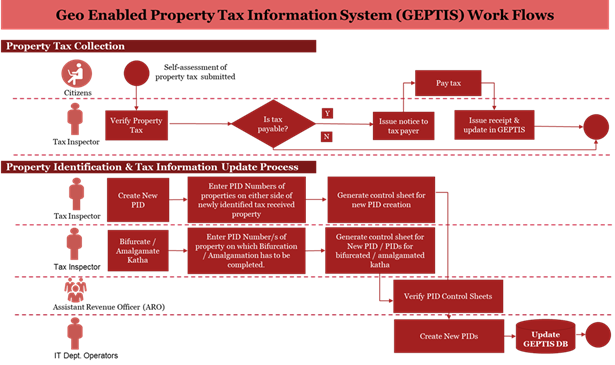

GEPTIS is an effective decision support system for identifying the use cases where Department officials can focus and target tax collection. The above workflows shows identification of probable tax payer information with the help of previous tax payment records which is fed into the system.

GEPTIS also helps in the mapping of unmapped properties and create a visual database for easy tax collection process. Any changes in the property information or tax payer is also recorded with data inputs from revenue officers and necessary situation of bifurcation or amalgamation of tax payers record (Khata) is updated in GEPTIS.